A debit-driven society (user research)

Too many millennials who carry debt don't know how spend it.

A survey ran by Northwestern Mutual comprised 503 Gen Zers, 672

millennials, 595 Gen Xers, and 441 baby boomers. On average,

millennials who carry debt report owing to a total of $27,900

(excluding mortgages), slightly less than baby boomers and about

$8,000 less than the average amount Gen Xers owe. 34% of Americans

don’t know how much of their monthly income goes toward paying down

their personal debt.

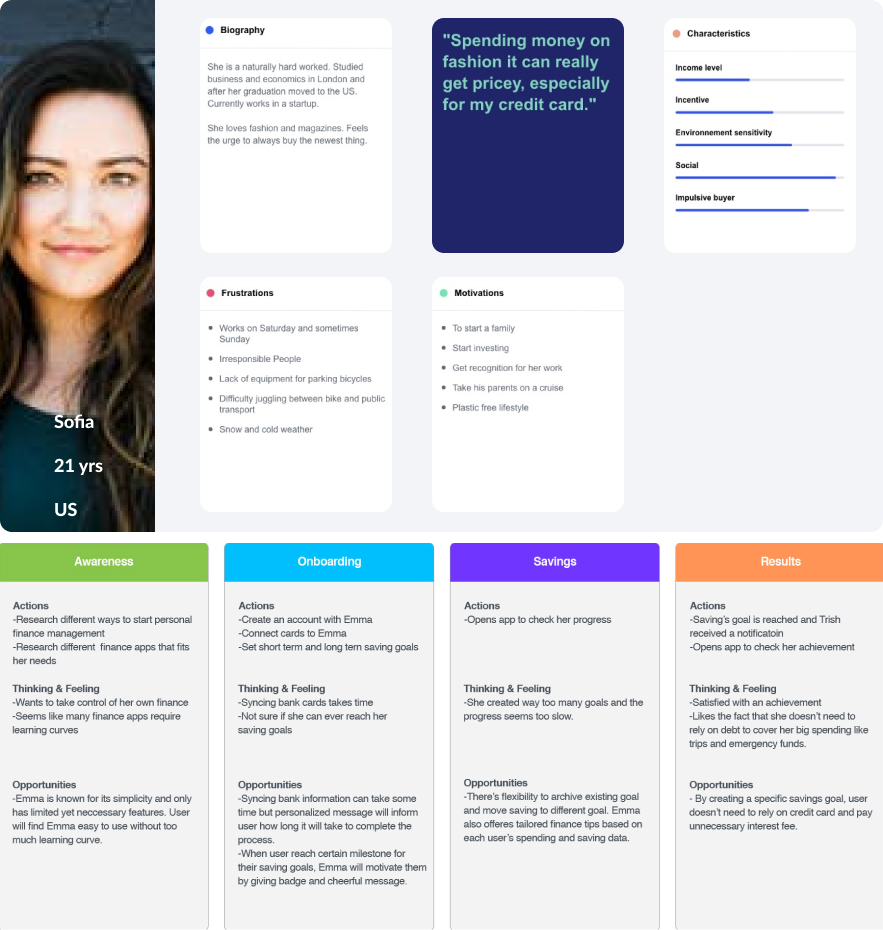

Debit is a struggle even for wealthy millennials

Making reference to a random twitter survey and google forms. The

survey had more than 1000 participant. From this survey, about

60%people don’t create budgets for their spending, 50% belong to

impulsively-purchasing.

Some insights from the survey:

-

It is safe to continue with the designing the solution to this

issue.

-

Users budgeting are very flexible. Some create budgets for their

weekly spending. Some others create budgets for their monthly

spending

-

Those who budget do so for financial discipline and to understand

how they spend their money.

-

Some users save a portion of their income and divert the other

portion to cater for their expenses.

Here is a list of the problems after prioritization:

- Inability to keep track of spending.

- Excessive spending on a particular expense.

- Lack of proper financial knowledge.

- Lack of access to previous financial records.

- Overly manual or stressful means of budgeting.

Based on data and feedback we collected we decided to state an

hypothesis that there might be decrease irrational purchase if there

were a better and easier way of preventing impulsive buying

Team

Duration: One Month

3 Designers & Researchers

My role

Lead ux designer and frontend developer in this project, led the

design and discovery phase of this project, conducted all of the

user interviews and user tests. I led efforts to evolve the

service and address customer pain-points related to spending and

planning experiences.

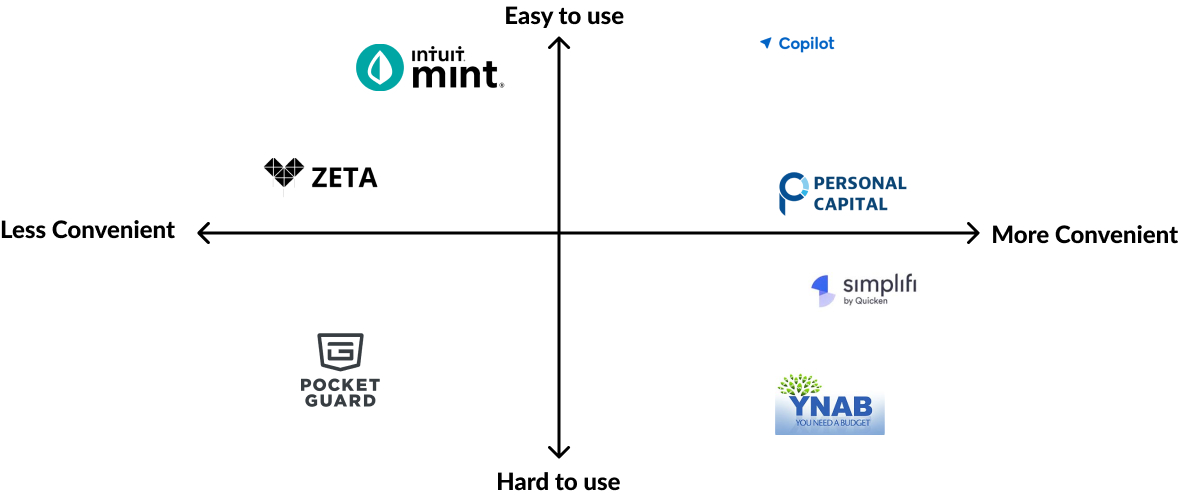

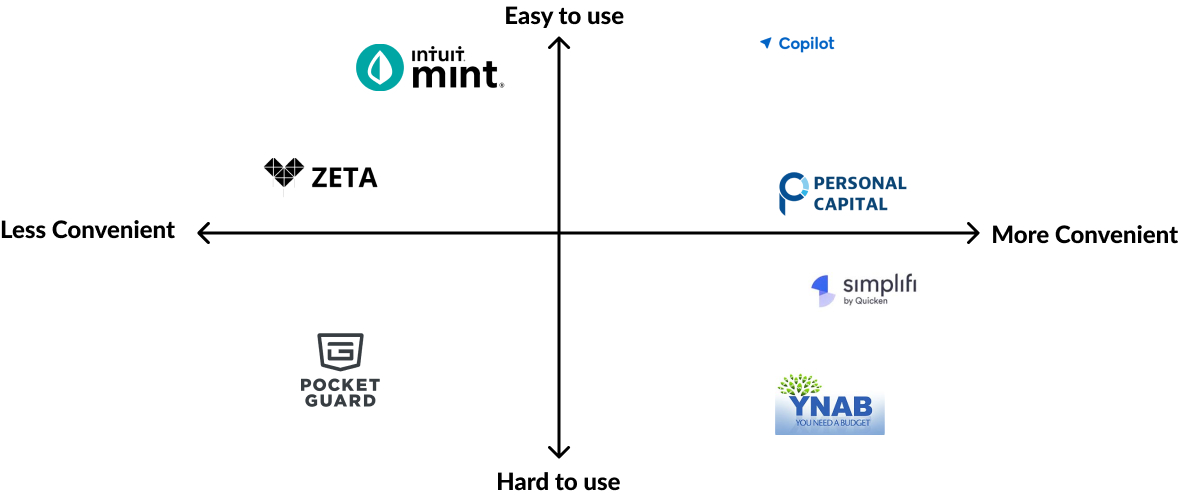

Competitive Analysis

I researched apps related to finances, budget and habit-building and

I end up with 7 apps. Then I filtered the ones related to financial

management as they could be the main competitors. At this point and

I was looking for their current features, and the overall experience

using some of them. Here are some features I found related to the

opportunities of the research:

- 2 of the 7 apps sync bank accounts automatically;

-

1 of the 7 reads SMS from the bank and add as a transaction — the

person has to copy the message and add in the app;

- 4 of the 7 send notifications;

-

7 of the 7 apps use charts to illustrate some expenses and

transactions.

Some insights from competitor analysis:

-

A good number of the apps favor app interaction in portrait mode.

- The apps have easily digestible financial reports.

- The apps all had simple and clean design.

Market Positioning

After the initial interviews and personas that I created, I set off

to figure out the market position for the product. The goal after

talking with everybody from users to stakeholders is the app to be

easy to use and convenient.

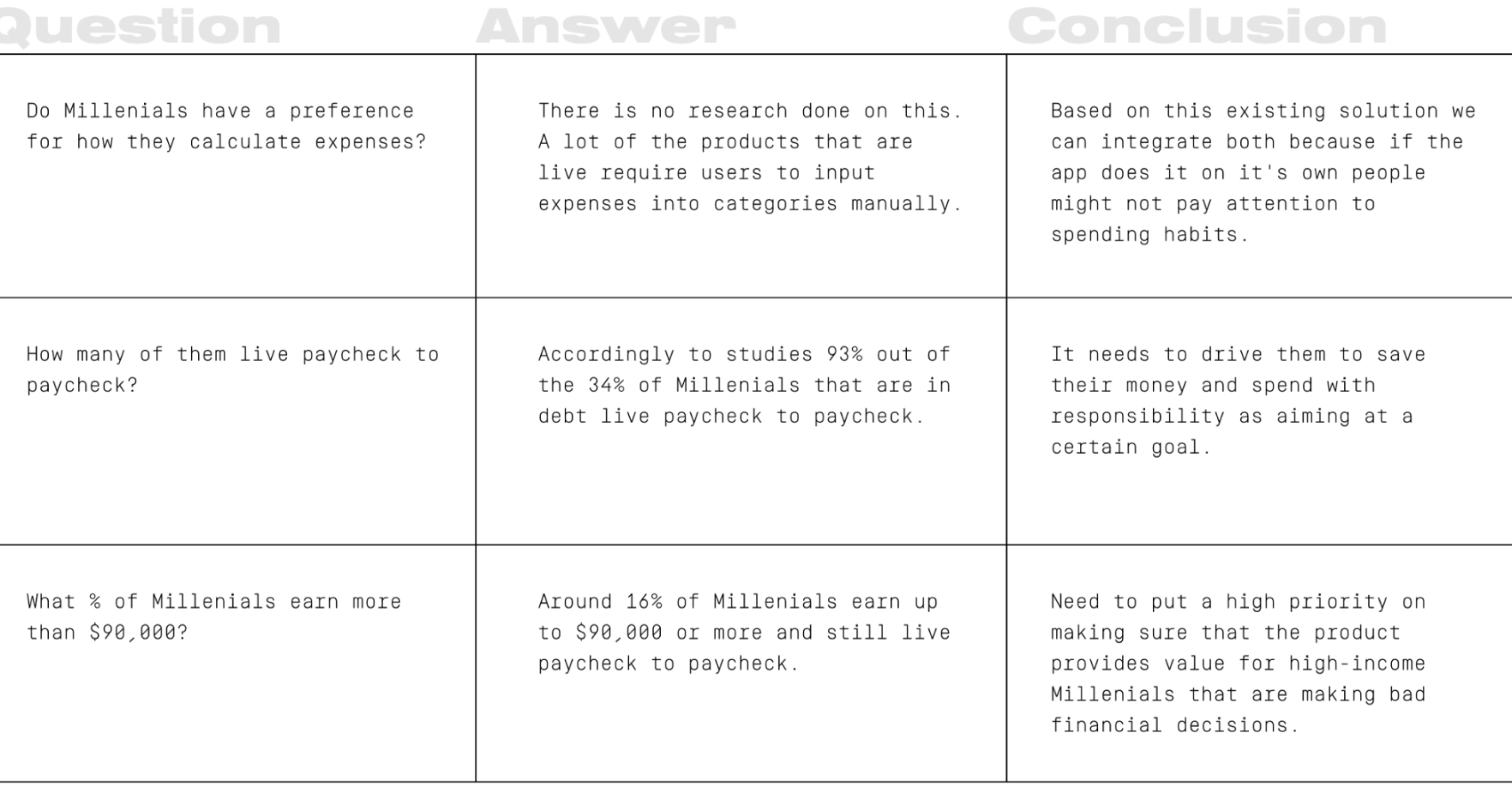

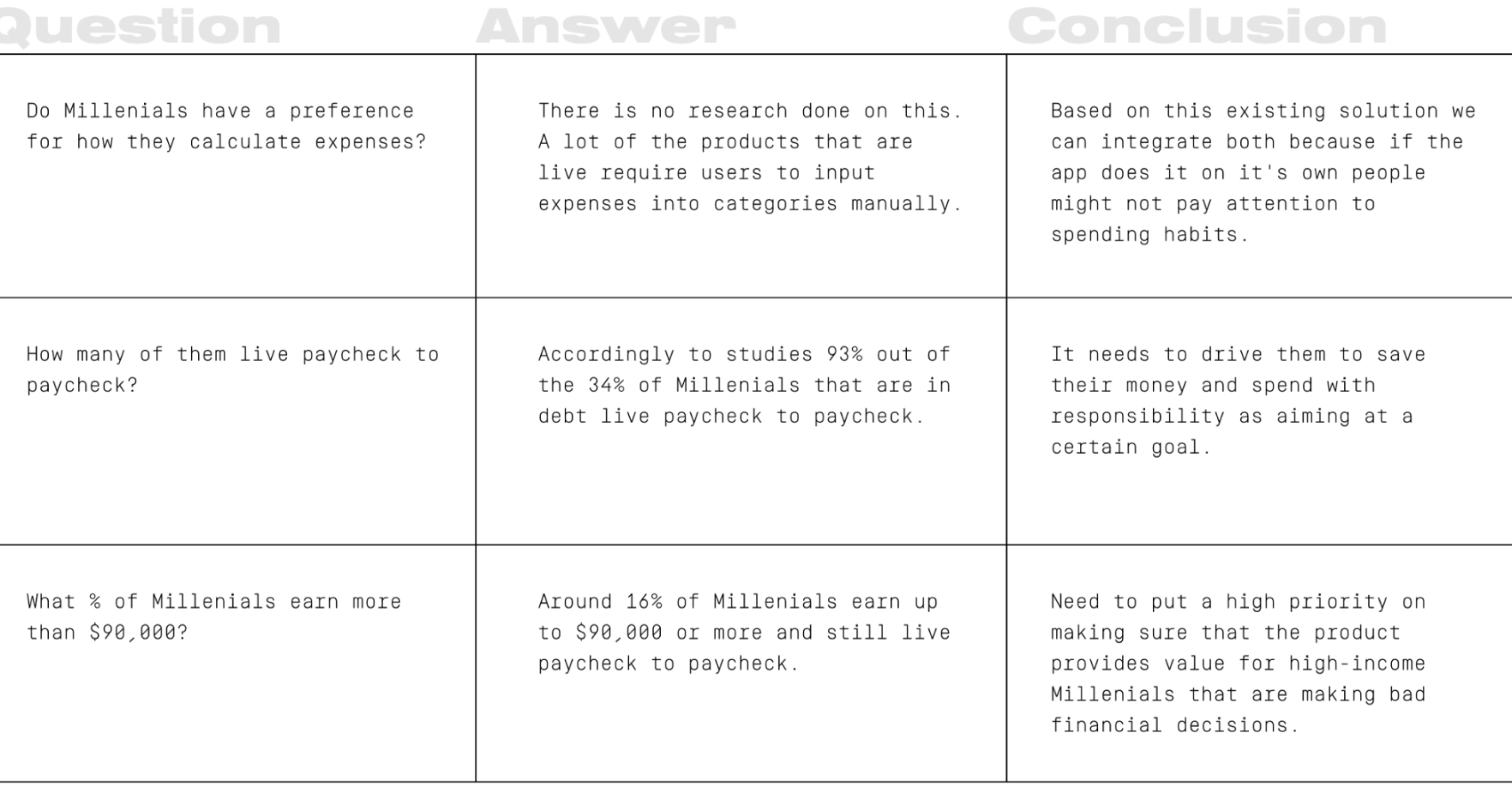

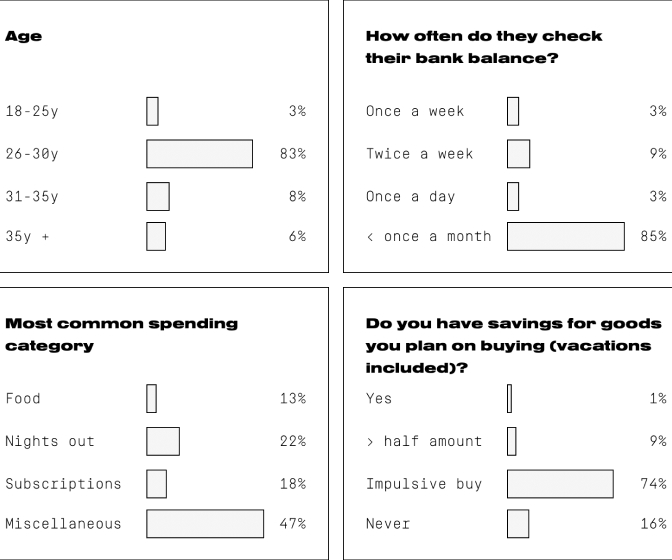

Survey Questions

The purpose of these questions is to gain insight into key data and

see if there is available information that would answer the

questions. There was no relevant information around the topics of

interest so I went about creating a survey to gather some real-world

data.

Survey results

I created a google form and send it out to people in our contact

list. The survey was filled by 197 people.

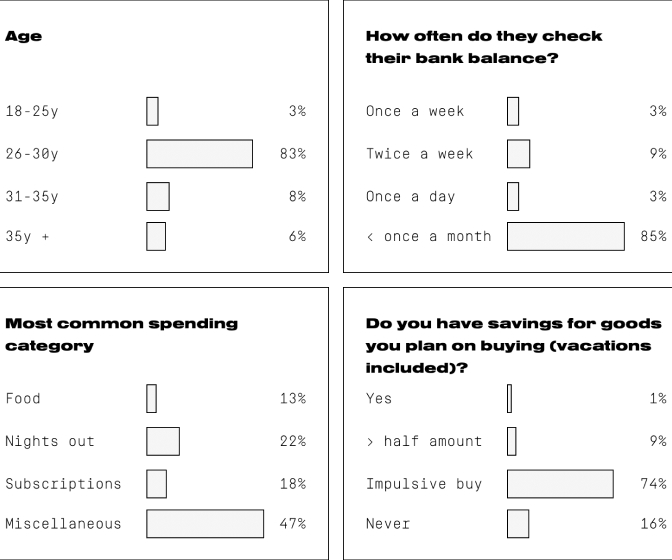

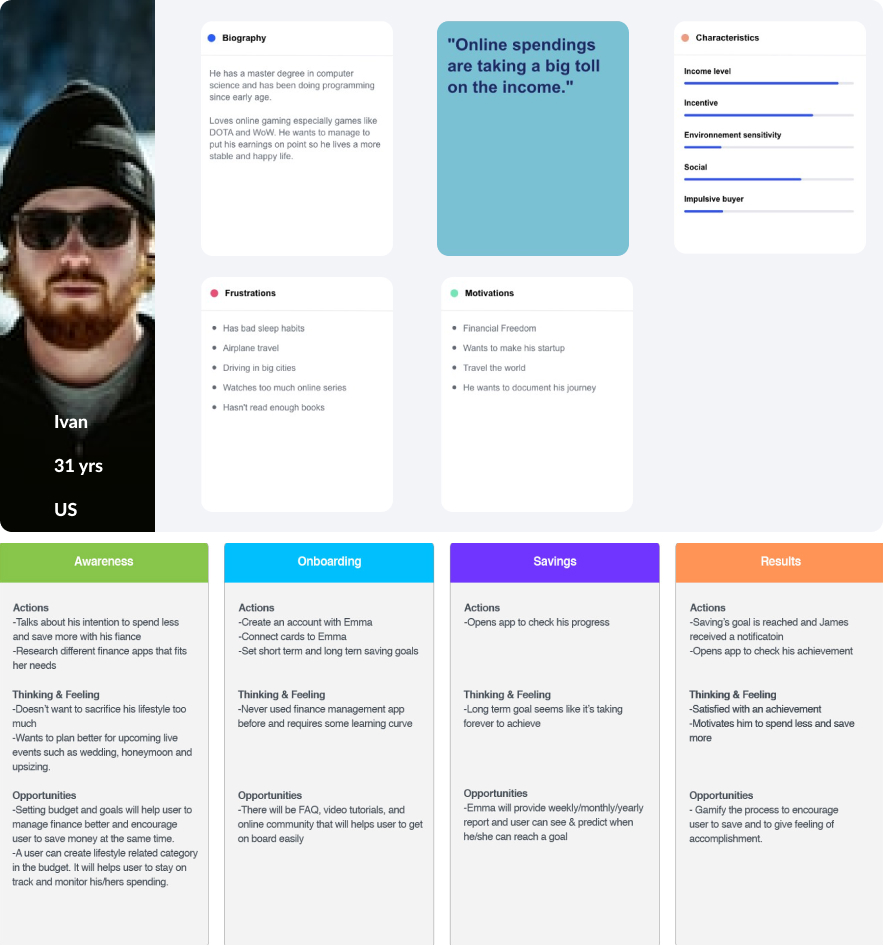

Empathy

I set off to learn about how do people actually spend— especially

why do we have so many tools at our disposal and still people are

terrible at spendings. 100% of the users are real people, focused on

the mindset they shared with me I created two separate user personas

based on my assumptions after the interviews.

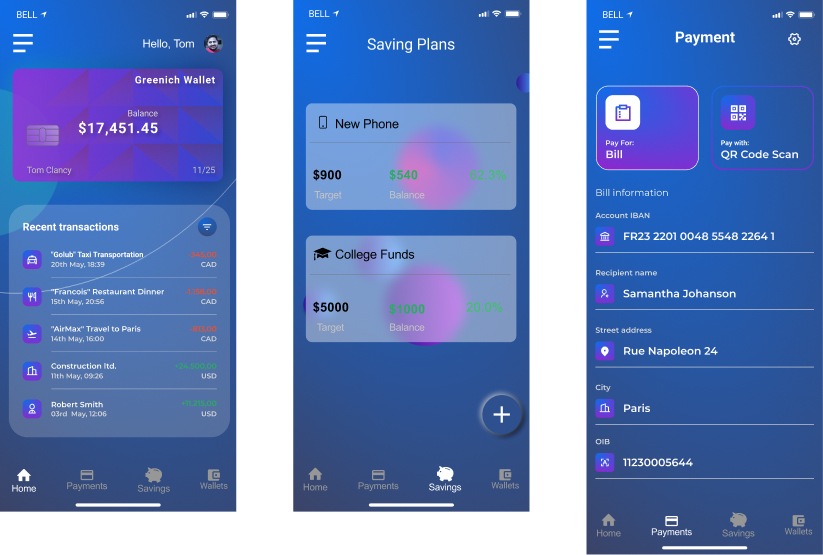

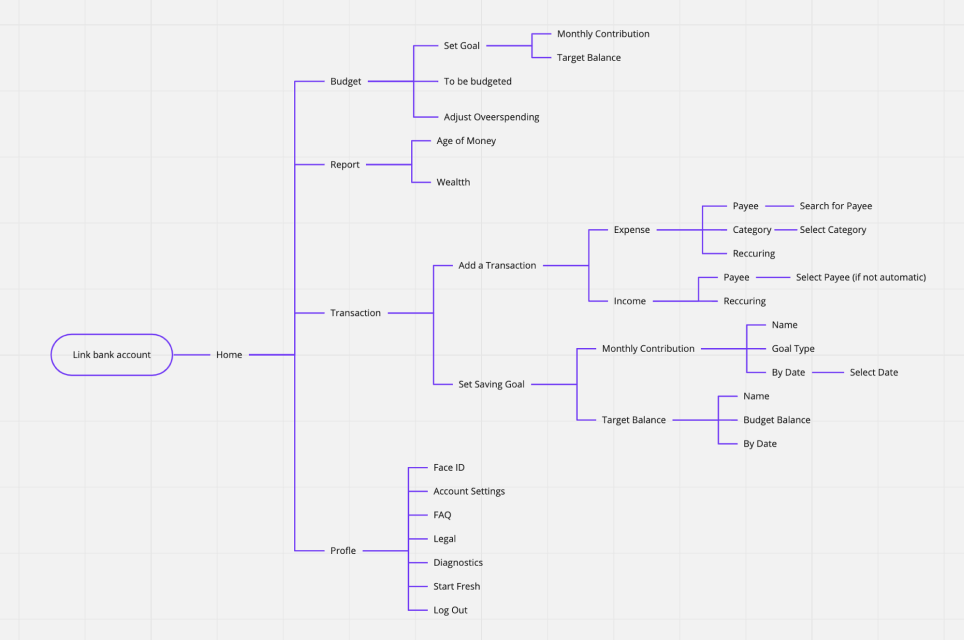

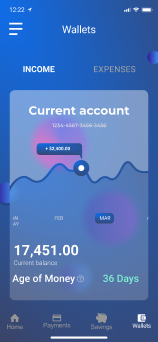

Accountable as a solution

After identifying the needs, problems and frustration of the

possible users, I tried to solve them and introduce the necessary

features to meet the users’ needs.

- Features of Accountable

- Cash inflow and cash outflow access

- Financial reports

- Flexible budget creation

- Bank accounts management

- Subscription management

- Funds categorization

- Expected characteristics of accountable

- Easily digestible reports

- Easy to use

- Simple design

- Conventional and less formal tone

- Possibility of access to previous financial reports

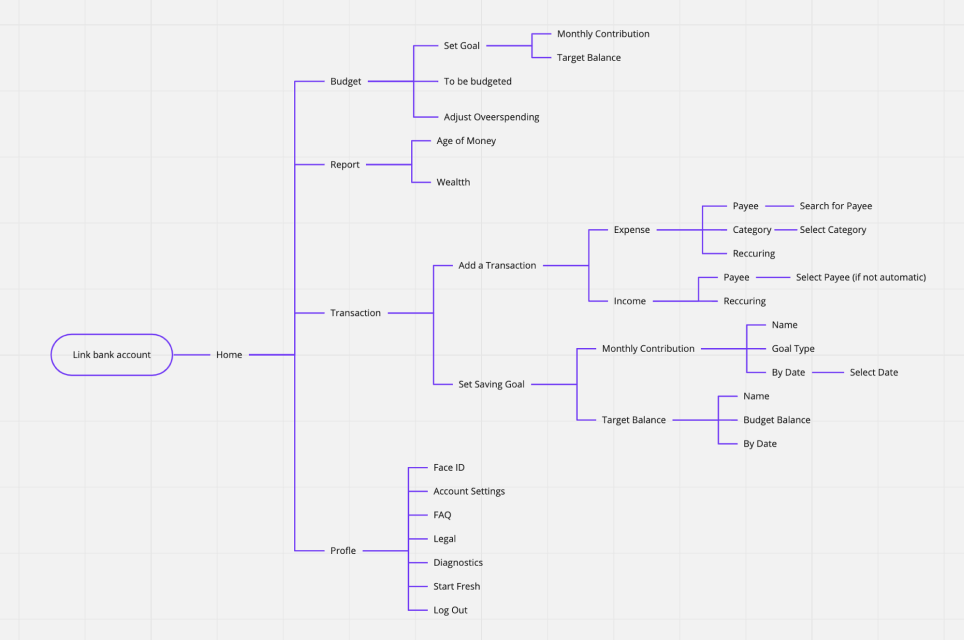

Site Map

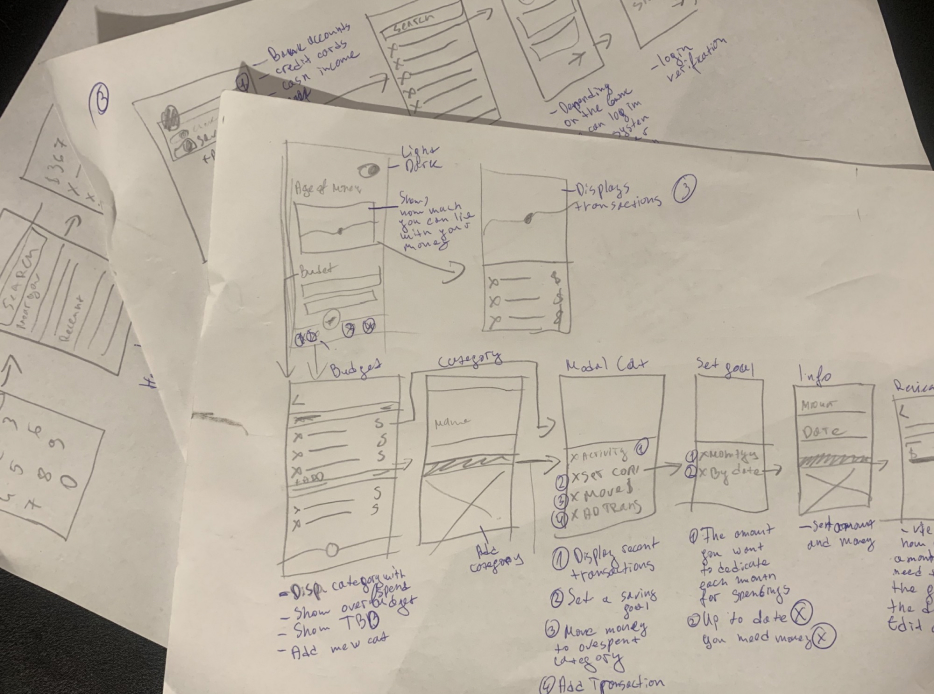

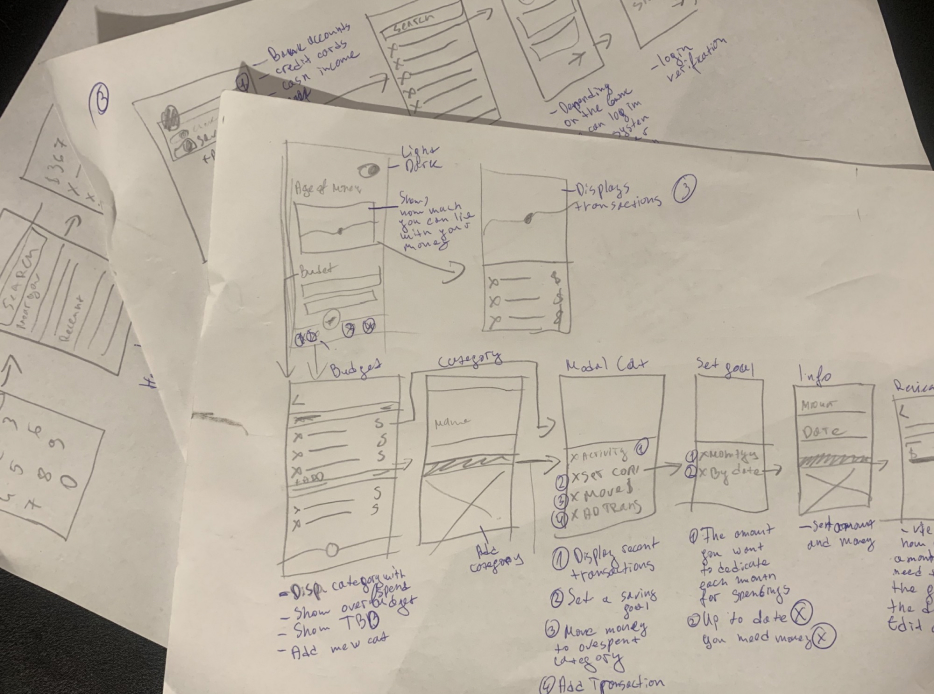

Early Sketches

We usually start the design process with low fidelity sketches. In

this time, we started to test the demo site searching for pain

points. After we analysed what users got confused from, we took

these insights and made some sketches on paper. Later, we propose UI

by Look & Feel pages. When our client chose the preferred one, we

started to built up the high fidelity prototype using Sketch. We

iterated after every user test and that is how we got our final

desktop screens. The last part was to interpret bigger screens into

smaller phone screens.

Usability Testing

Being the creep I am, I gave few people phone with the prototype

on it and whispered into their ear while looking over their

shoulders 3 questions

This below is the script I had prepared for the session.

Hey [name]. thanks for taking the time. I was telling you about

the app I am working on, and now would need to test a prototype

with you, it shouldn't take more than 15–30 minutes of your

time. I’ll ask you to complete just three tasks and that’s all

-

You have received $890 in cash instead of in your bank

account. You need to add it into your money to be budgeted,

how would you do that?

-

Let’s say we need that money to be added to category RENT.

Let’s add $500 and $90 to electricity. The rest $300 you add

to Groceries. How would you do that?

-

The last one is very simple. You have overspent on a category

called Eating out. How would you move $57 from Rent to Earing

out?

Thank you very much! You really helped me a lot! It is important

for me to receive feedback early on and to try to validate my

assumptions.

Summary

My goal was to validate if Millenials really understood how to

operate with their money and plan accordingly. I was excited about

this idea so a reality check was much needed.

Outcome:

-

All participants managed to add the money to be budgeted.

- All of the participants managed to pass the 3 tasks.

-

Around half of the users got a little bit stuck about

converting money from one category to another.

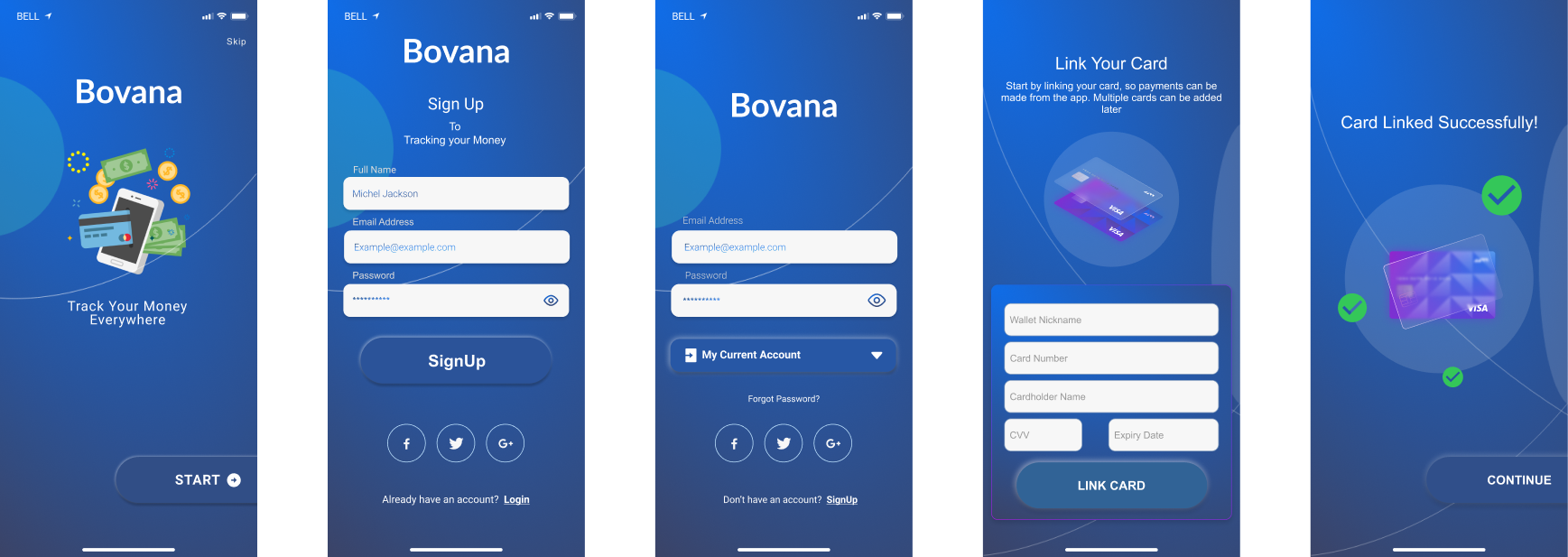

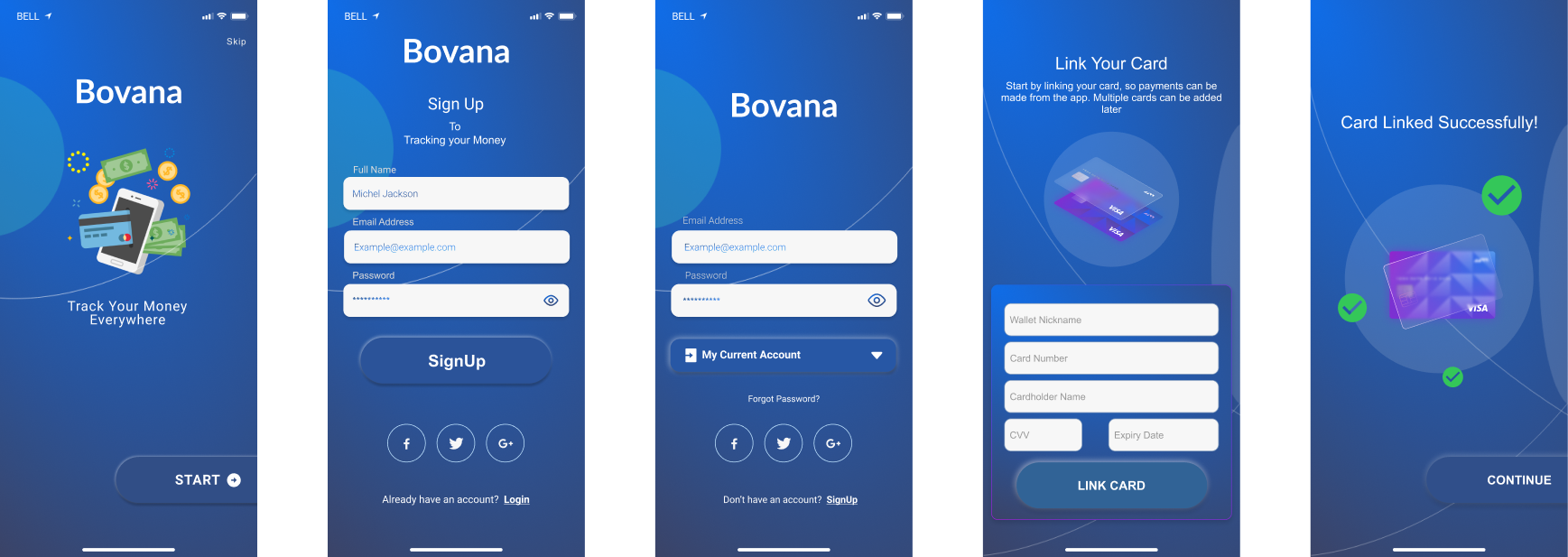

Final UI which I did

I tried to focus on features related to solving some of the major

desired outcomes found in the initial research. The app should be

simple and easy to understand. Also, encouraging them to build

financial habits. Here are the highlighted features:

- Link Accounts

-

Ease of adding accounts to give you a clear overview right away

-

The ease of adding a bank account and credit card is vital for the

success of this product. If somehow your bank doesn’t allow to

login and gets statements you can always add your finances

manually on a later stage.

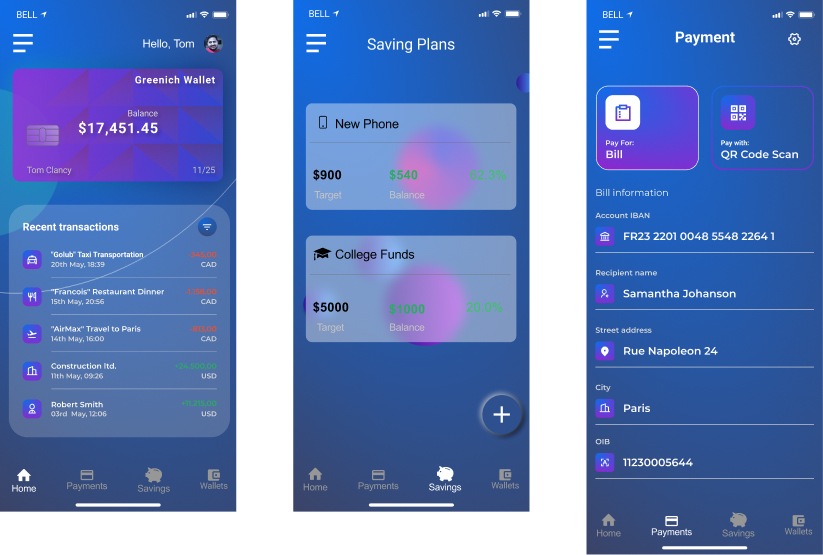

Main function page

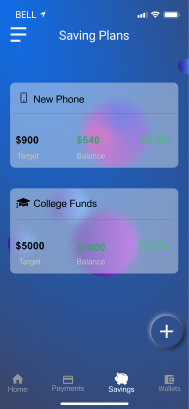

Set Goals

Monthly Contribution

Target Balance

The purpose of this is to achieve goals easier. By setting goals

with a monthly contribution you will have an automatic payment

to that “bucket” every single month. When you set the payment to

Target Balance it’s free, however, you can set deadlines by

which date you want to achieve that.

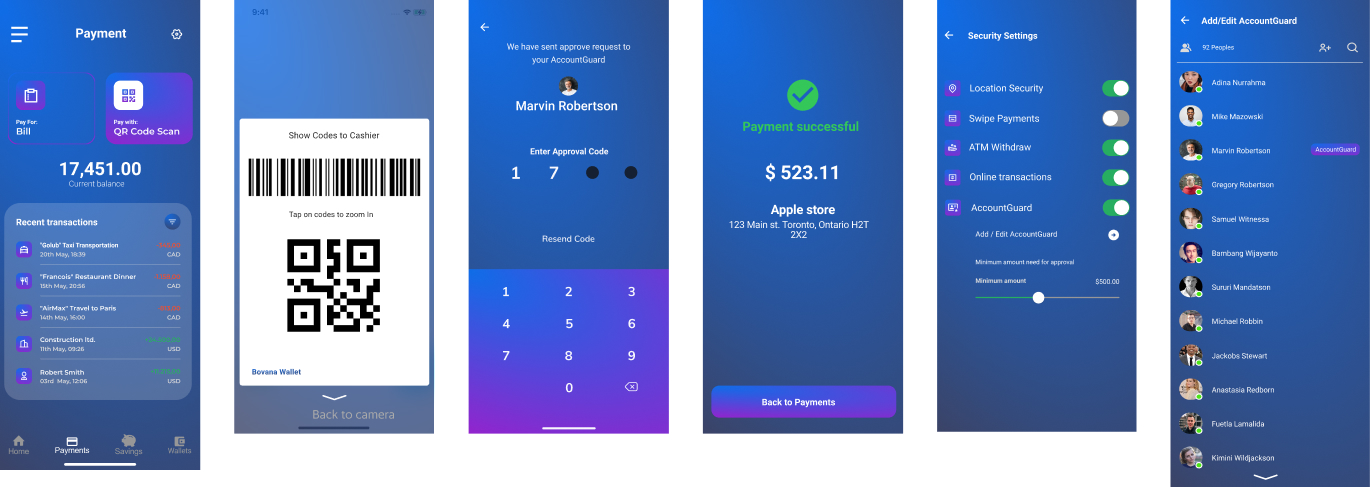

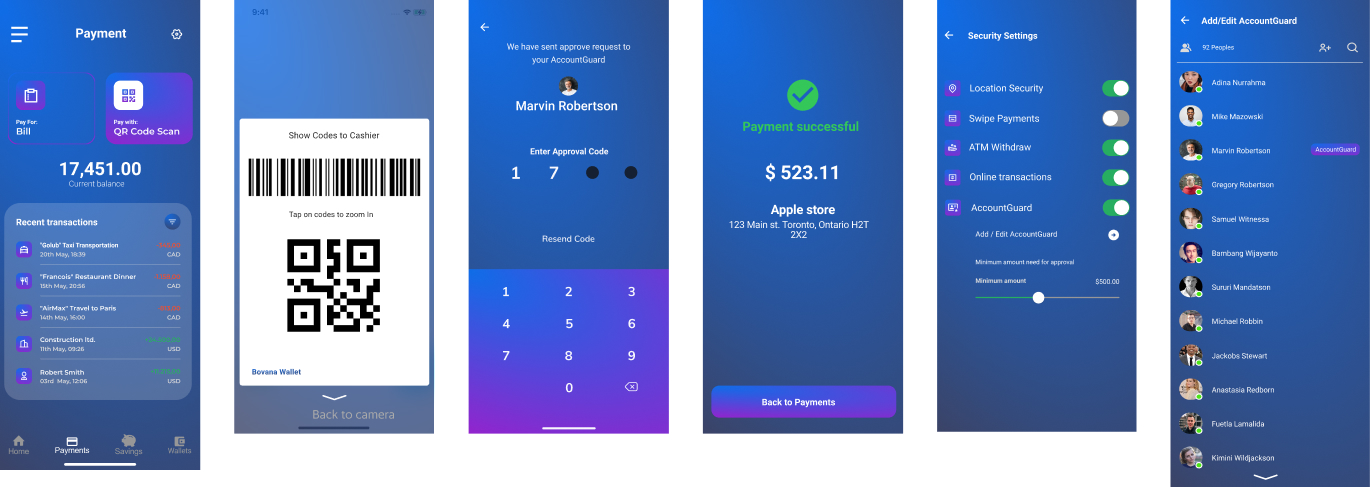

Payment method

If the payment over the limit which set in security setting, system

will send approval request to your accountguard, the app will

continue payment process if you have approval code, why we add

barrier in the process, because we hope user can stop and thinking,

then to avoid impulsively-purchasing.

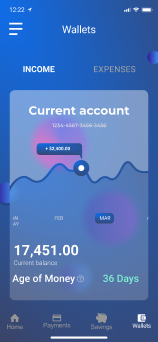

Provide Age of money information to help user understand personal

financial health

Main learnings

Know your audience – Paying and giving credit card details makes

users suspicious. Even under safe conditions, sometimes a bunch of

lock icons (🔒) really helps make them truly believe you. :) Also,

copy factors very highly here, which takes us to the next point.

…and how to talk to them (Improve your writing skills) – As

mentioned, copywriting makes up an important element of UX. We need

to improve not just the visual but the written communication skills

too.